Capital

Majority of the funds we manage are our own. We deploy capital with brokers to trade on their proprietary trading book. We use the leverage extended by brokers to reduce strategy risks.

Skills

The founding team along with experienced team members have a total trading experience of over 35 years. We use our market experience and skills to create multiple strategies in different asset classes. We take into account multiple risk-reward parameters including non-correlation of strategies to ensure consistency in profits.

Risk Management System (RMS)

At Scale Up, we believe no one can earn huge money for you unless you do it yourself. 85% of large cap funds do not beat NIFTY. So this means you would have been better off opening a broking account and investing in NIFTY bees rather than listening to sales pitches of mutual fund agents.

Hence, we manage our own money and do not manage clients funds. We are manufacturers and directly go to the market and try to earn consistent profits. We are not agents, no fees earned, no client calls etc.

Strategy level risks are managed by us using maker-checker principle to avoid execution issues.

Book level risks are managed at two levels:

1) We use an in-house created software to monitor positions and quantify exposure and risks. We then hedge it appropriately.

2) Brokers have their own risk management team to track our positions and ensure that possible losses (if any) are within the pre-determined levels.

Technology

We leverage technology to track our live positions, quantify and control risks. On top of using few applications available in the market, we have created an in-house tech team to enhance risk management and trade execution capabilities.

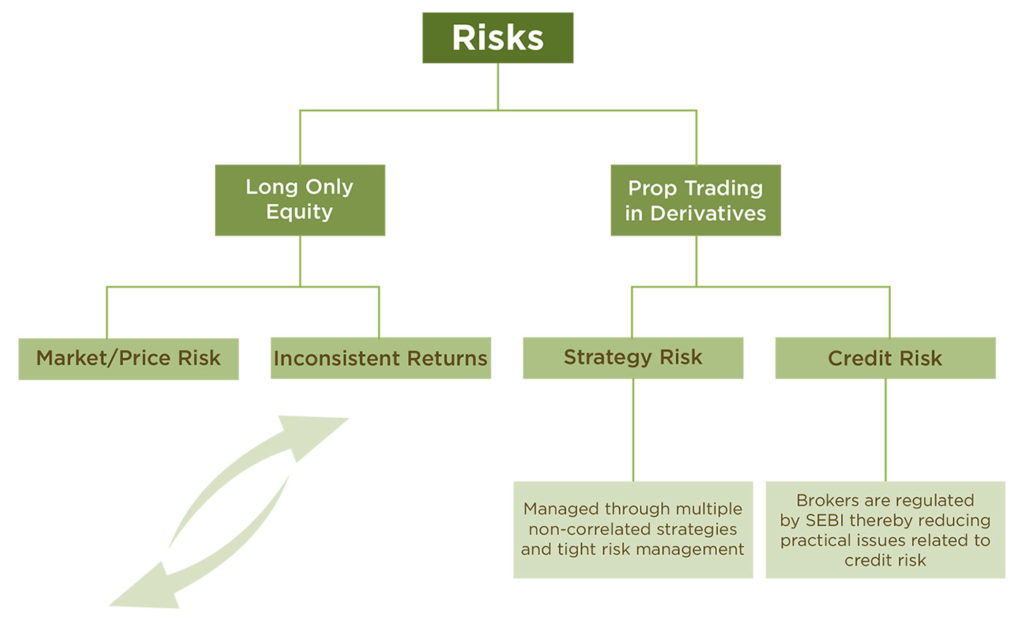

Market / Price Risk

The term market risk, also known as systematic risk, refers to the uncertainty associated with any investment decision. Price volatility often arises due to unanticipated fluctuations in factors that commonly affect the entire financial market.

Inconsistent Returns

In a long only portfolio, returns are not linear. While most of the portfolio returns are generated during uptrend, there are market phases when prices are range bound or falling. This results in inconsistent annual returns and not conducive for a trading business where objective is to generate regular cash flows.

Strategy Risk

There are many strategies that can be created using financial derivatives. Some work during range bound markets while few others need market to move directionally. Strategies can also be different in terms of asset classes and time periods. Strategy risk in trading is highest if only a specific strategy is deployed.

Credit Risk

Margin money placed with brokers to take derivatives position has a credit risk that gets triggered if the broker goes bankrupt and is unable to refund the margin money.

If you loved reading this, please check out our podcast on this.

Purpose

Growth with Service

We know we can code but we won’t!

Yes, in today’s world everything can be coded, converted to algorithms and executed by the best softwares. In trading as well, we know that we can code all our trades and don’t need human beings to trade. But consciously, we decided to have freshers in our team, teach them trading and give them trades so that we do our bit in contributing to our nation! Sounds stupid to some and amazing to some!

Harish and Saumil both are India Lovers. They always wanted to see how they can contribute to nation building. But in life, they just knew one thing – trading! How can you merge trading and nation building? Seemed like looking London talking Tokyo. After a lot of thought, Scale Up decided to build a team of freshers (yes! We hired people who didn’t know anything about markets – forget derivatives) We cherrypicked members of our team not from big named colleges but the opposite! – by having interviews and asking questions only about their backgrounds and goals in life and goals towards their family – nothing to do with markets.

We train them not only on trading but also for other aspects of financial markets so that they can contribute this knowledge and percolate it in their lives. We encourage them to take their own insurance, start their SIP and be financially prudent.

Our vision is to have a thriving business of trading in financial derivatives but not just for us. We want our team to grow with us and cherish the journey we all undertake together.