Power of Derivatives

In financial markets, you can either be investing or trading. Investing, is not a business per se. You can invest in financial markets and simultaneously do your job or business.

Speaking about business of investing, we do have lot of people in the business of investing – they are called fund managers. Their main income typically is salary or a small percentage of the performance. They do not take the risk of loss. If an investor loses money, they still get their salary.

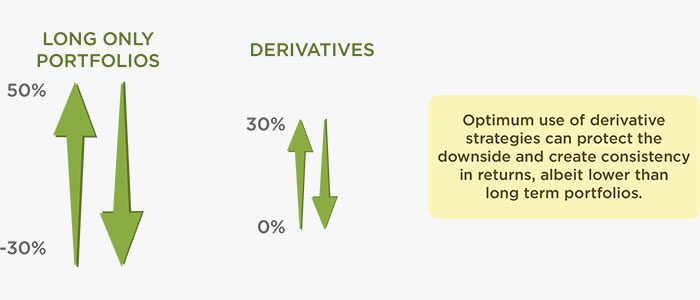

Also, typically in the asset management industry , products are long only – which means if markets go north, you make money. If they go south, you lose money.

In trading, there again are two types of business. One – which people do for clients – like broking houses calling you and coercing you to trade so that they can earn brokerage. We know quite a number of people hired in broking companies who have brokerage targets! So much so for the spirit of investor protection!

There also exists a small section of people called proprietary traders. They are generally not known to the social media world. These people trade for themselves. They do not earn commission from others and they are willing to TAKE THE RISK!

SO who are they? Before knowing them, let’s take a look at derivative markets in general.

Trading is a full time business. It is the same as starting a steel manufacturing plant. The moment we download the broking app and we hit that option sell button, its as mammoth as starting a steel manufacturing plant. The odds of winning in trading are same as odds of being successful in manufacturing of steel, or any other business. The whole point we are trying to make here is Trading is a FULL TIME BUSINESS – Its not part time, its not adventure. The odds of winning in trading are same as odds of winning in any other business.

Market Size

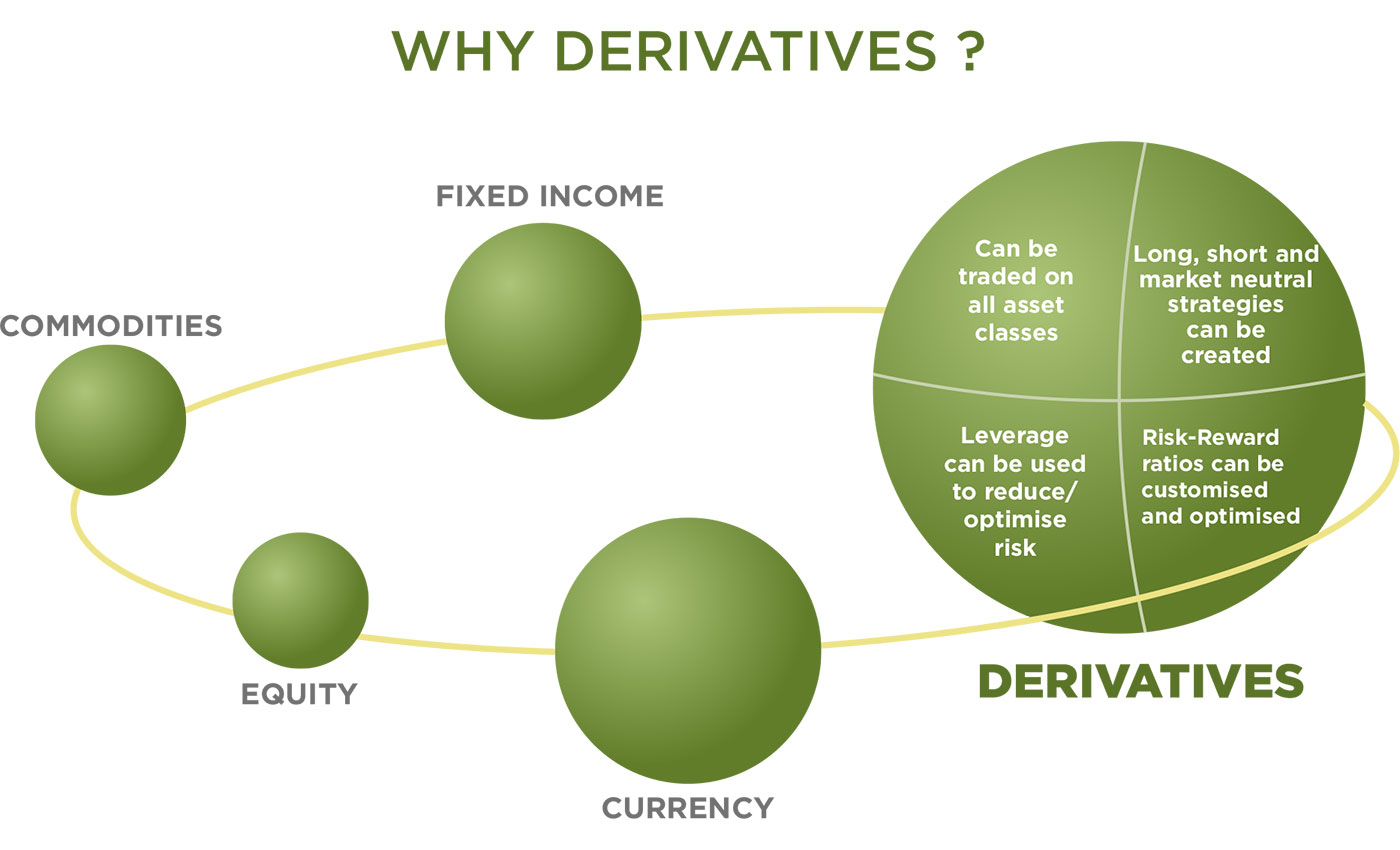

Volumes in the derivatives segment are multiple times more than underlying equity markets.

Flexibility

Strategies can be created to benefit from all types of market views (bullish, bearish and range-bound) asset classes and time frames ranging from 1 minute to 5 years.

Leverage

Derivatives offer leverage which can be utilised to optimise risk or to blow up capital. An important thing to note is that 9 out of 10 traders lose money. The one who survives earns all the money lost by the other 9. We take advantage of this market segment’s inherent zero sum game feature.

Here is an explanation:

If there are 100 people in front of you right now and all of them invest in NIFTY index. After 20 years, all of them would have been successful in making money because the assumption is that India will grow in 20 years, since India will grow – all the top 50 companies of India (NIFTY) shall grow and investors would earn.

Wealth transfer: In the above case, no one is technically losing money as ultimately we are betting on INDIA.

But if there are 100 people in front of you right now and all of them instead of investing in NIFTY, start trading in derivatives. It is for sure that 90 of them would lose and only 10 would eventually win.

Wealth transfer: In the above case, those 90 people who lose would transfer the wealth to 10 who win. Please see the image as to why the 90 lost and why the 10 won. The 10 trade smart!

Please note derivative volumes are almost 7-8 times of equity market volumes! And the earning ratio is skewed 90:10!!

PS: These 90 in turn meet a lot of middlemen in the industry (like mutual fund agents, LIC agents) and make them listen to their sob stories. These middlemen instead of digging deep in derivatives subject, form a negative opinion about derivatives and get one more point added in their sales pitch on why to avoid derivative trading.